Founded: 1877

Location: 310 Jackson St., Scales Mound, Ill.

Employees: 3

Phone: 815-845-2325

SCALES MOUND, Ill. — For decades, if you wanted to find a physical office for an insurance company based in northern Jo Daviess County, you’d have to enter someone’s home.

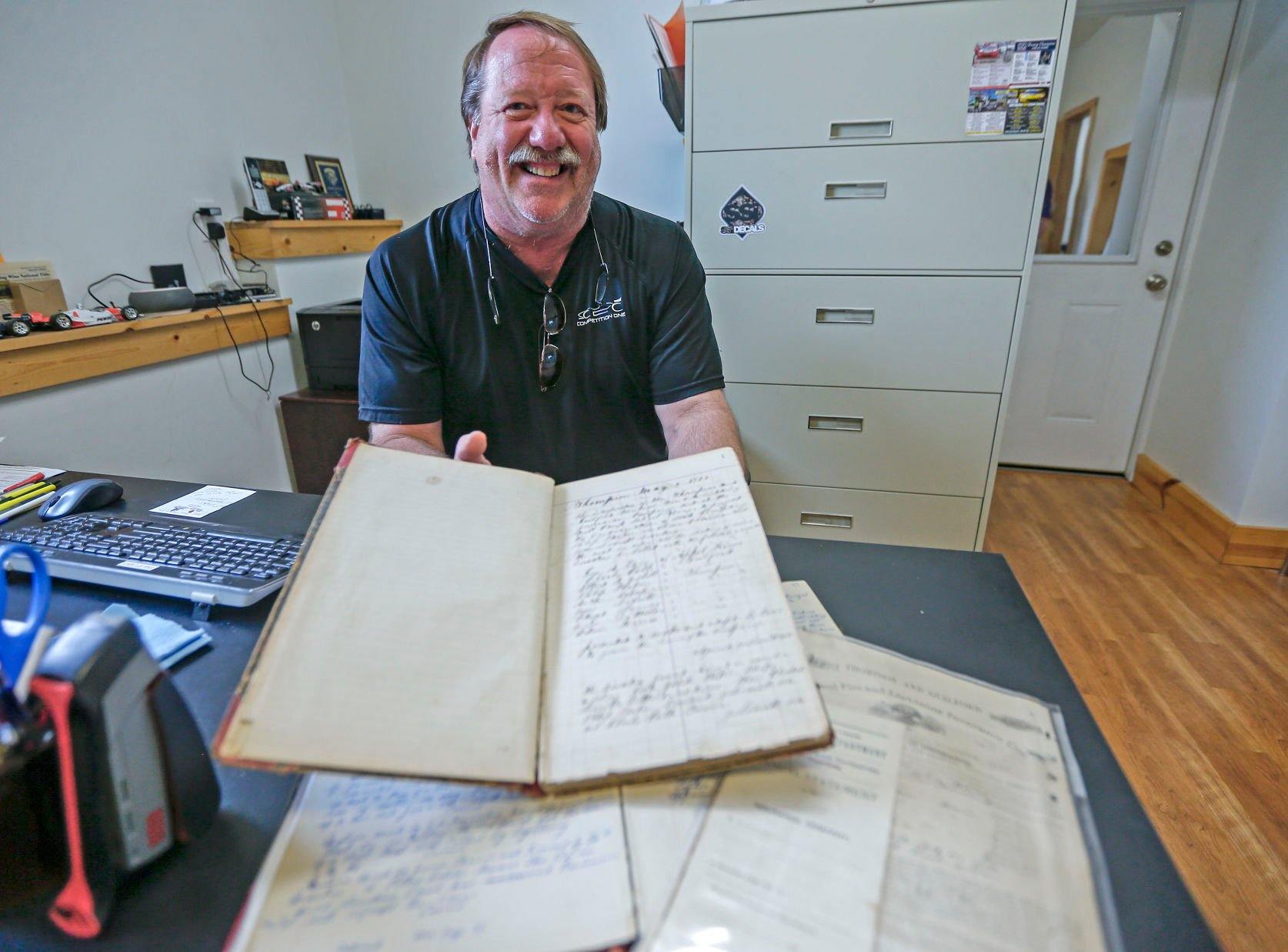

“The company had never had a home office, so to speak,” said Steve Stadel, manager of Thompson & Guilford Mutual Insurance.

That’s not to say the company has never had a home.

Stadel said the 145-year-old firm is like other mutual insurance companies. It is owned by all of its policyholders. Thus, the business’ true home has been scattered across farmland in Scales Mound and surrounding areas of northwest Illinois — in the farms and residences of the people it has insured.

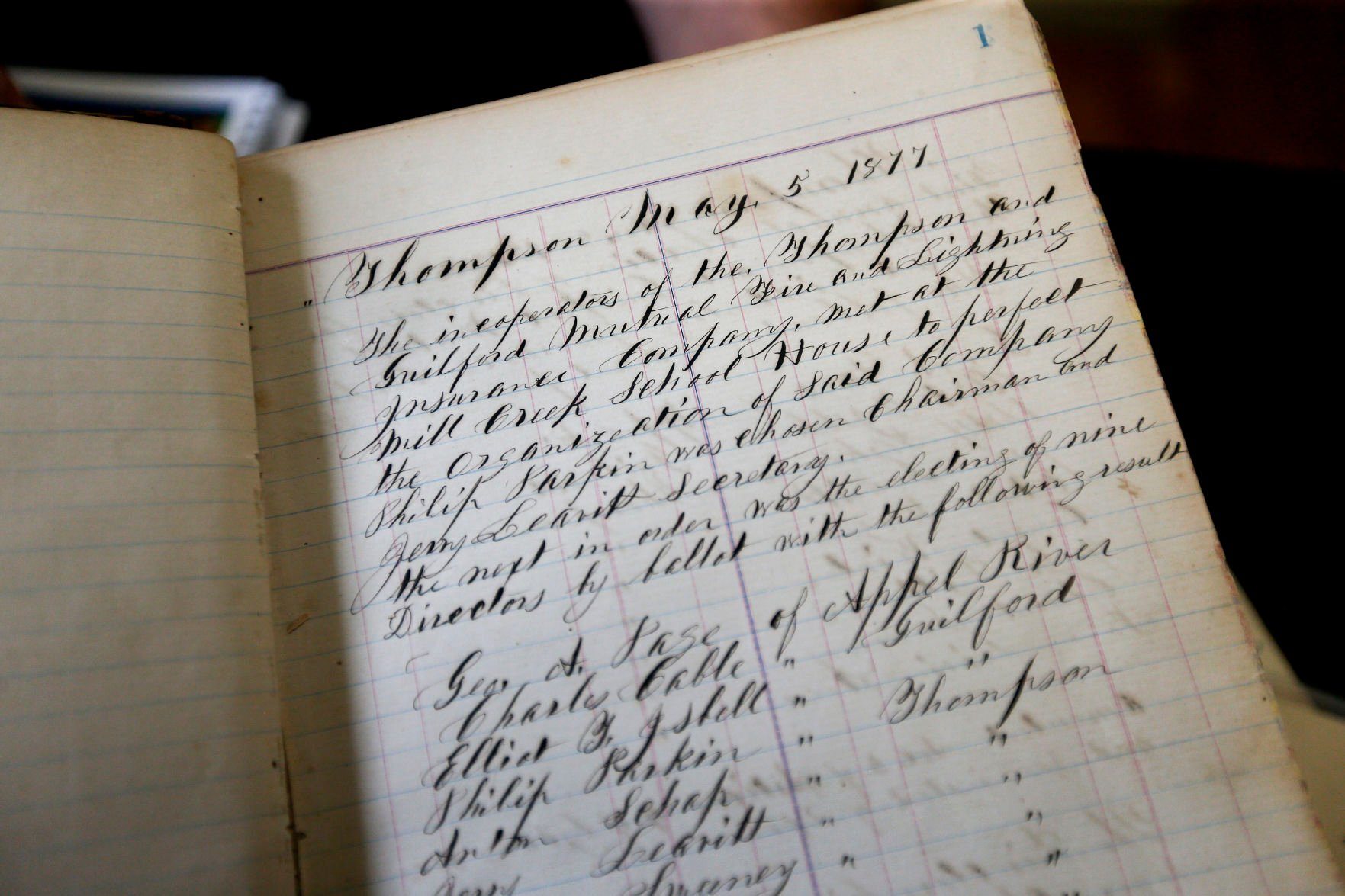

The company was founded in 1877, when mutual insurance rules of the late 19th century enabled farmers to collectively insure their property against loss.

“It’s kind of a co-op concept,” said Joel Holland, president of Thompson & Guilford’s board of directors. “Mutuals were formed when there wasn’t a lot of interest in insuring (agricultural communities), so it was a way for communities to self-insure in case a neighbor lost a barn or a cow.”

The company has a nine-member board consisting of policyholders.

It just hasn’t had a specific building to call home.

“The company had never owned a building in all of its years,” Stadel said. “It has utilized different town halls for their annual meetings, and any office had been in the secretaries’ homes.”

Stadel’s mother, the late Helen Stadel, became the company’s secretary in the early 1970s.

“Our house was where the office was, in the basement,” Stadel said.

The company office moved out of the Stadel basement in 1978, when Helen Stadel purchased a building on North Avenue in Scales Mound.

“It was apartments at the time, and she converted one of the apartments into an office,” Stadel said. “That was the first actual commercial-type office that the company was ever in.”

Helen Stadel also co-owned an insurance company. She managed Thompson & Guilford until 1990, when her son took over. In 2013, Steve Stadel relocated Thompson & Guilford, as well as his insurance and tax accounting agencies, to a location on Jackson Street, where the offices remain.

“It’s a neat little success story,” Holland said.

Holland’s family connections to Thompson & Guilford run deep.

“My great-grandfather was president of Thompson & Guilford 100 years ago,” Holland said. “My great-aunt was secretary for a number of years. My dad was president for a number of years, and my grandpa on my mom’s side was also involved in Thompson & Guilford.”

Scales Mound was platted in 1853, and Thompson & Guilford began in 1877.

“Scales Mound and the immediate area was very farming related,” Stadel said. “A lot of people had small farms back then.”

The company’s name reflects its geographic location in northern Jo Daviess County. It’s named after a pair of local townships.

“Thompson Township is directly south of (Scales Mound) and a little east, and Guilford Township, which is south of here and a little west,” Stadel said. “To put it geographically, Apple Canyon Lake is fully in Thompson Township, while Galena Territory is almost all in Guilford Township.”

An unincorporated settlement called Schapville, in Guilford Township, is where Thompson & Guilford held its annual meetings in its earliest years.

“We’ve been around a long time,” Stadel said.

Holland said the company has adapted to the times throughout its history.

“It has survived world wars, the Great Depression and the farm crisis of the ’80s,” he said. “One hundred years ago, (company officials) would have never thought of insuring homes in Apple Canyon Lake or Galena Territory. Those can be seven-figure dwellings.”

The company has adapted and grown, according to Stadel.

“The company is the largest it has ever been,” he said.

In 1895, the company insured property valued at $491,000. The company insures about $177 million worth of property.

“Last year, for the first time, we went over $1 million in insurance policy surplus,” Stadel said.

The surplus represents the company’s cash and securities on hand less liabilities — in this case, the costs that would be incurred if every policy holder canceled immediately and required refunded premiums.

“When I took over in 1990 from my mom, we had $90,000 in the bank,” Stadel said. “We’re at about $1.4 million now.”

Thompson & Guilford officials attribute some of the company’s growth in recent years to its reinsurer, Grinnell Mutual. A reinsurer is a company that provides financial protection to insurance companies by handling risks that are too large for an insurance company to handle on its own.

“They have been a great partner over the years,” Holland said.

Stadel is 61, and though he is not yet ready to retire from managing Thompson & Guilford, he is looking ahead to when that time comes.

“I’ve been doing this for 32 years, and I’m not getting younger,” he said. “One of my goals is succession.

“I’d like to find someone to take over. I do want to oversee the next person who comes in and takes my position. I would like to know that it’s going to be in good hands for the next 30 years after I have left the company.”