LONDON — U.K. inflation accelerated for the first time in four months in February as high food and energy prices hit consumers battered by the nation’s cost-of-living crisis.

The consumer price index jumped to 10.4% in the 12 months through February from 10.1% the previous month, the Office for National Statistics said today. The figures surprised analysts who had forecast inflation would slow to 9.9%.

The figures increased pressure on the Bank of England to approve an 11th consecutive interest rate increase when it meets on Thursday, regardless of concerns about the economic impact of strains on the global banking system. Many economists now expect the central bank to boost its key bank rate by at least a quarter percentage point.

“In recent days, some have suggested that the febrile environment in the banking sector should give central banks pause for thought before raising rates further,” said Kitty Ussher, chief economist at the Institute of Directors, a business lobby. “Today’s data suggests the opposite — the Bank of England’s job is not yet done.”

Bank of England policymakers have struggled to contain the fallout from Russia’s war in Ukraine, which drove up the cost of food and energy. Those pressures have in turn fueled broader price increases and demands for higher wages.

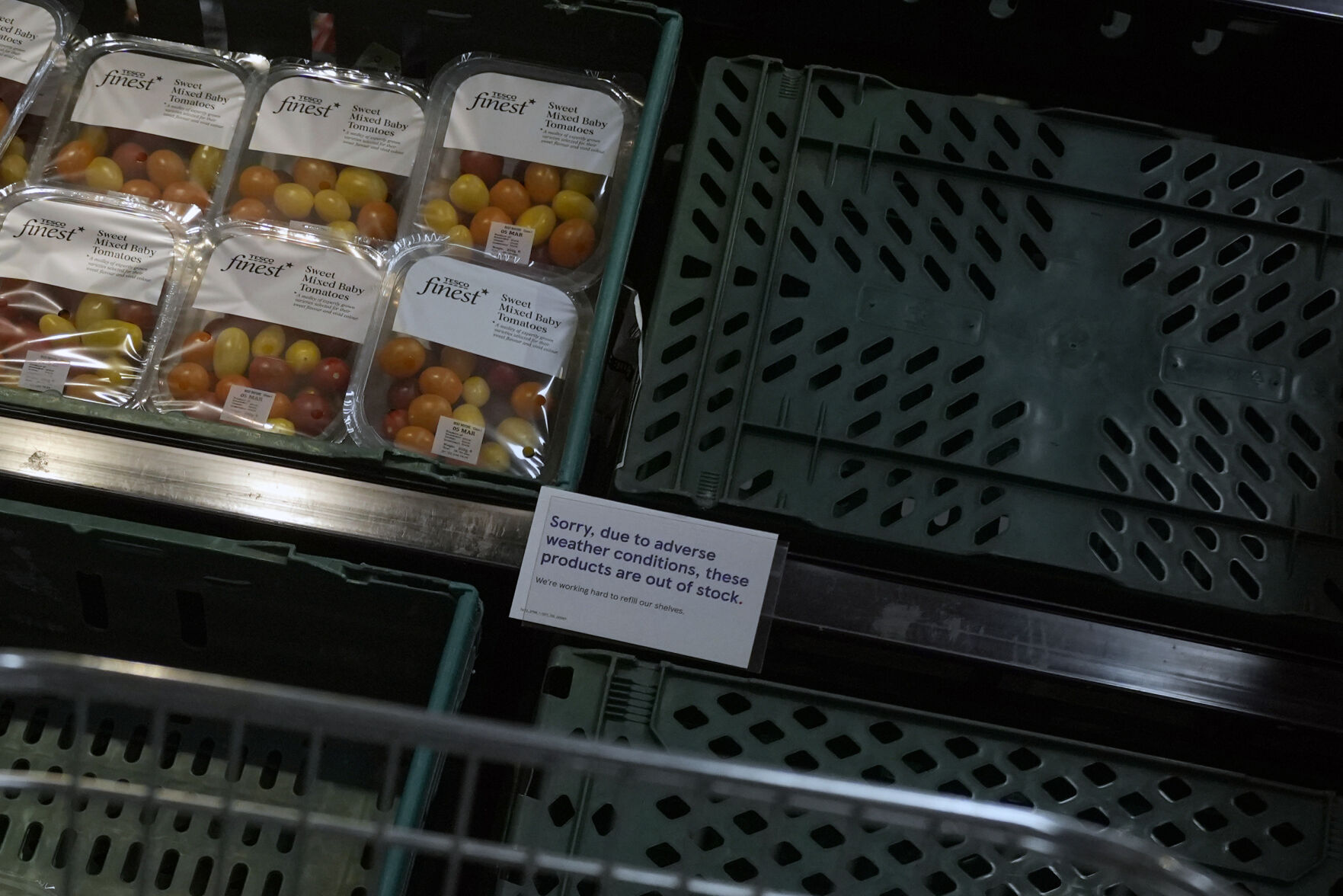

The inflation report highlights the pressures faced by British consumers who spent the winter with one eye on their thermostats and the other watching the steady rise of prices for staples such as milk, eggs and vegetables as the nation’s cost-of-living crisis triggered the biggest decline in living standards since the 1950s.

“February’s surprise increase in inflation will raise more concerns for households whose budgets are already stretched to their limits,” said George Dibb of the Institute for Public Policy Research, a progressive think tank. “With some of the biggest contributions to rising prices coming from essentials like food, drinks and clothing, most households will find that their pay packet doesn’t stretch as far.”

Food prices jumped 18% in the 12 months through February, compared with the 16.7% rate recorded the previous month.

Even after government subsidies designed to shield consumers from the jump in global energy prices, the average household bill for electricity and natural gas rose 27% last year.

Economists expect inflation to slow rapidly later this year as recent declines in wholesale energy prices feed through to consumers and last year’s big price increases drop out of the calculations.

The Bank of England forecast inflation will drop to 2.9% by the end of this year.

But U.K. Treasury chief Jeremy Hunt warned that more work is needed to head off further price increases.

“Falling inflation isn’t inevitable, so we need to stick to our plan,” he said.