Following the recent half-percent cut to the federal interest rate, local financial experts say those interested in purchasing a home can shop for a mortgage with less trepidation.

With more cuts expected on the horizon, the climate for consumers looking to finance big-ticket items such as homes or vehicles is expected to remain friendly, but the effects of inflation — such as higher grocery costs — are here to stay.

The federal funds target rate, often called the federal interest rate, is a mechanism used by the U.S. Federal Reserve to regulate the economy. The number, which is presented as a range, has wide-reaching impacts across the financial spectrum. The rate currently sits at 4.75% to 5%.

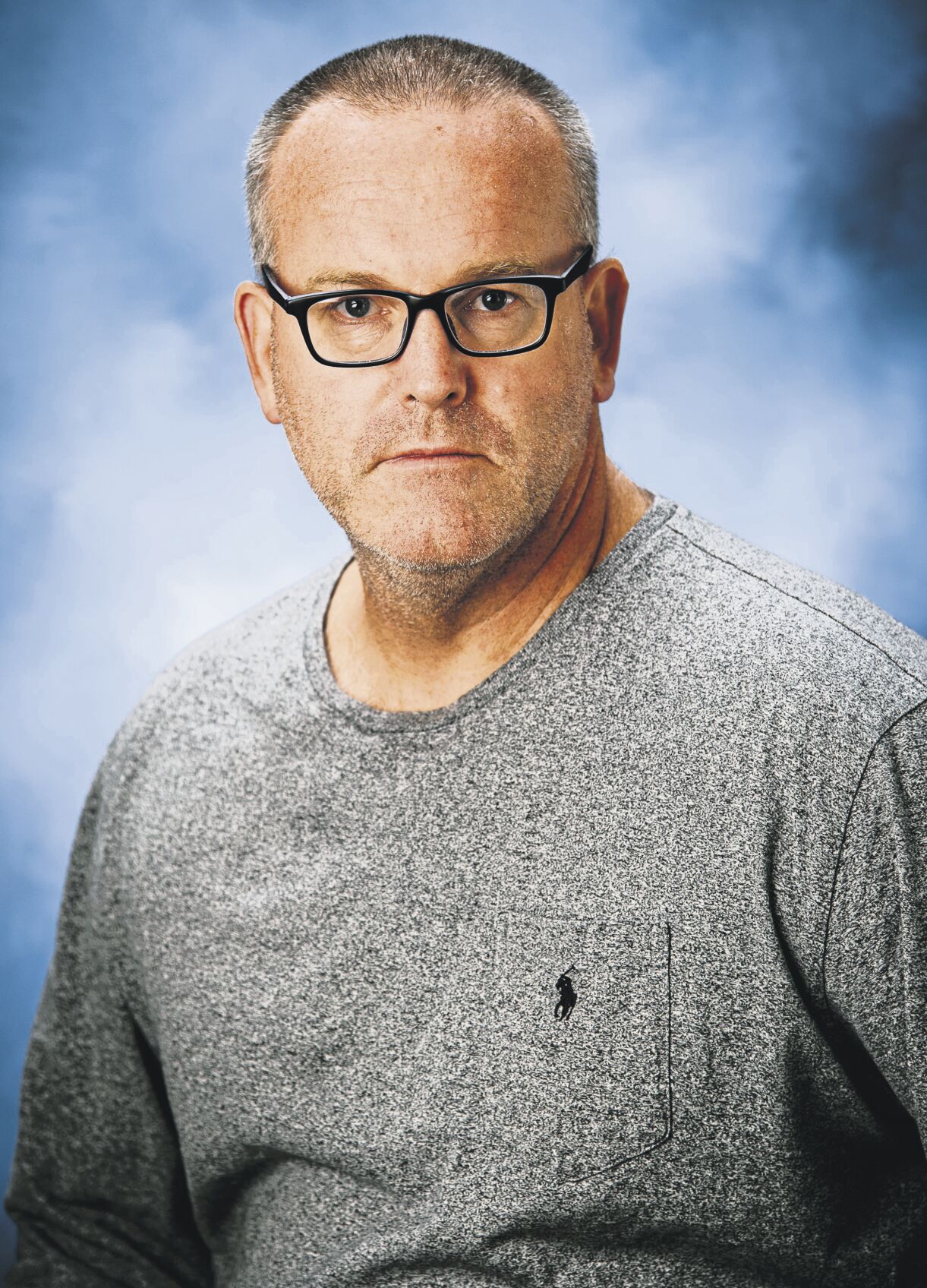

“(It) is the rate at which banks trade money and pass money on to each other,” said Eric Munshower, professor of economics at the University of Dubuque. “As they cut that rate, they are adding liquidity to the system and encouraging loaning by making the interest rate go down.”

If the economy exhibits too much inflation — driven by variables such as supply and demand, consumer attitudes and fiscal policy — the Federal Reserve raises the federal interest rate to slow spending.

In August, the U.S. inflation rate was 2.5%, its lowest mark since February 2021. However, that doesn’t mean prices on daily goods are going down.

“You’ll see relief on the rate of increase, but prices are not going to go back down, if you will,” Munshower said. “There is not a … deflation to the corresponding inflation we have had. Part of consumer frustration is there has to be a readjustment of our expectations of what costs should be. I am not waiting to see 49-cent eggs again.”

On the flip side, when unemployment gets too high, the federal interest rate is cut to spur investment.

When national unemployment spiked to nearly 15% in April 2020 following pandemic-related lockdowns that halted the economy, the Federal Reserve held two emergency meetings and slashed its rate to 0%. Since March 2022, the Fed has incrementally raised the rate to cool the spending encouraged by the cuts.

Prior to Sept. 18, the rate was 5.25% to 5.50% — its highest point since May 2000 during a period called the “Dot-Com Boom” that was fueled in part by investors pumping money into tech startups as the internet bloomed.

The U.S. Federal Reserve’s seven-person board announced the latest cut on Sept. 18. It was no surprise to financial institutions.

Sam Devine, chief investment officer at Fidelity Bank & Trust, said a transparent Federal Reserve led by Chair Jerome Powell communicates its expected interest rate cuts in advance so the market can react accordingly.

“What (Powell) has done is by being more transparent, he has taken the reading of the tea leaves out of the game,” Munshower added. “What the Fed has signaled is if they can keep inflation trending downward, they intend to continue to lower interest rates.”

Short-term interest rates attached to things such as high-yield savings accounts or money market accounts are directly affected by cuts to the federal interest rate, which can make such accounts less lucrative.

“A one-year CD (certificate of deposit) rate has gone from around 5.5% to 4% in the last five months,” said Devine. “That’s a huge impact.”

That drop in short-term interest rates also affects long-term interest rates — which the federal government does not directly control — such as mortgages and car loans. They, too, are dropping.

Mortgage interest rates, for example, are determined by a variety of factors, including the borrower’s credit score, market conditions and geographical location. Freddie Mac reports the average interest rate on a 30-year mortgage in the U.S. this week is 6.08%, nearly two percentage points lower than where it was at its pandemic-era peak — 7.79% — at the end of October 2023. The average national mortgage interest rate in January 2021 — when the federal interest rate was 0% — was an all-time low of 2.65%.

The recent mortgage interest rate drop has led to an uptick in people refinancing their mortgages.

“You see people who are looking to refinance back to a lower mortgage (interest rate),” said Brian Kallback, an assistant professor of finance at Loras College. “… Historically, this (federal interest rate cut) should allow rates to come down. But it’s not a one-to-one correlation.”

Those looking to refinance should temper their expectations about how much mortgage interest rates will drop, financial experts said.

“It’s not clear at all that you will get a home loan at 3.5% in the near future,” Munshower said. “We have long-term budgetary problems in the U.S.”

But, those wanting to purchase a home now can harbor some cautious optimism when entering the market, Kallback said.

“I think if you are in the market for a house and you can afford it, I would do it,” Devine echoed. “I would not wait for rates to come down.”

Another group of people who will be affected by the federal interest rate cut are those who already have accumulated debt on lines of credit. Credit card interest rates also are impacted by the Fed and should respond accordingly, Kallback said.

“Credit card rates are at record highs, and the assumption is they will come down,” Kallback said.

Though, like mortgage rates, it’s not an overnight change, and Kallback cautioned anyone from changing their long-term outlook on paying off lines of credit.

“I wouldn’t expect (credit) rates to come down quickly,” Kallback said. “People who have a debt repayment schedule or are paying off debt, (they should) continue to do that. Remain aggressive with balances even though rates are coming down.”