PARIS — Auto manufacturers competing to persuade drivers to go electric are rolling out cheaper, more tech-rich models at the Paris Motor Show, targeting everyone from luxury clients to students yet to receive their driving licenses.

The biennial show has long been a major industry showcase, tracing its history to 1898.

Chinese manufacturers are attending in force, despite European Union threats to punitively tax imports of their electric vehicles in a brewing trade war with Beijing. Long-established European manufacturers are fighting back with new efforts to win consumers who have balked at high-priced EVs.

Here’s a look at the show’s opening day on Monday.

MORE NEW MODELS FROM CHINA

Chinese EV startups Leapmotor and XPeng showcased models they said incorporate artificial intelligence technology.

Leapmotor, founded in 2015, unveiled a compact electric-powered SUV, the B10. It will be manufactured in Poland for European buyers, said Leapmotor’s head of product planning, Zhong Tianyue. Leapmotor didn’t announce a price for the B10 that will launch next year.

Leapmotor also said a smaller electric commuter car it showcased in Paris, the T03, will retail from a competitive 18,900 euros ($20,620). Those sold in France will be imported from China but assembled in Poland, Zhong said.

Leapmotor also announced a starting price of 36,400 euros ($39,700) in Europe for its larger family car, the C10.

Sales outside of China are through a joint venture with Stellantis, the world’s fourth largest carmaker. Leapmotor said European sales started in September.

XPENG BRACES FOR TARIFF HIT

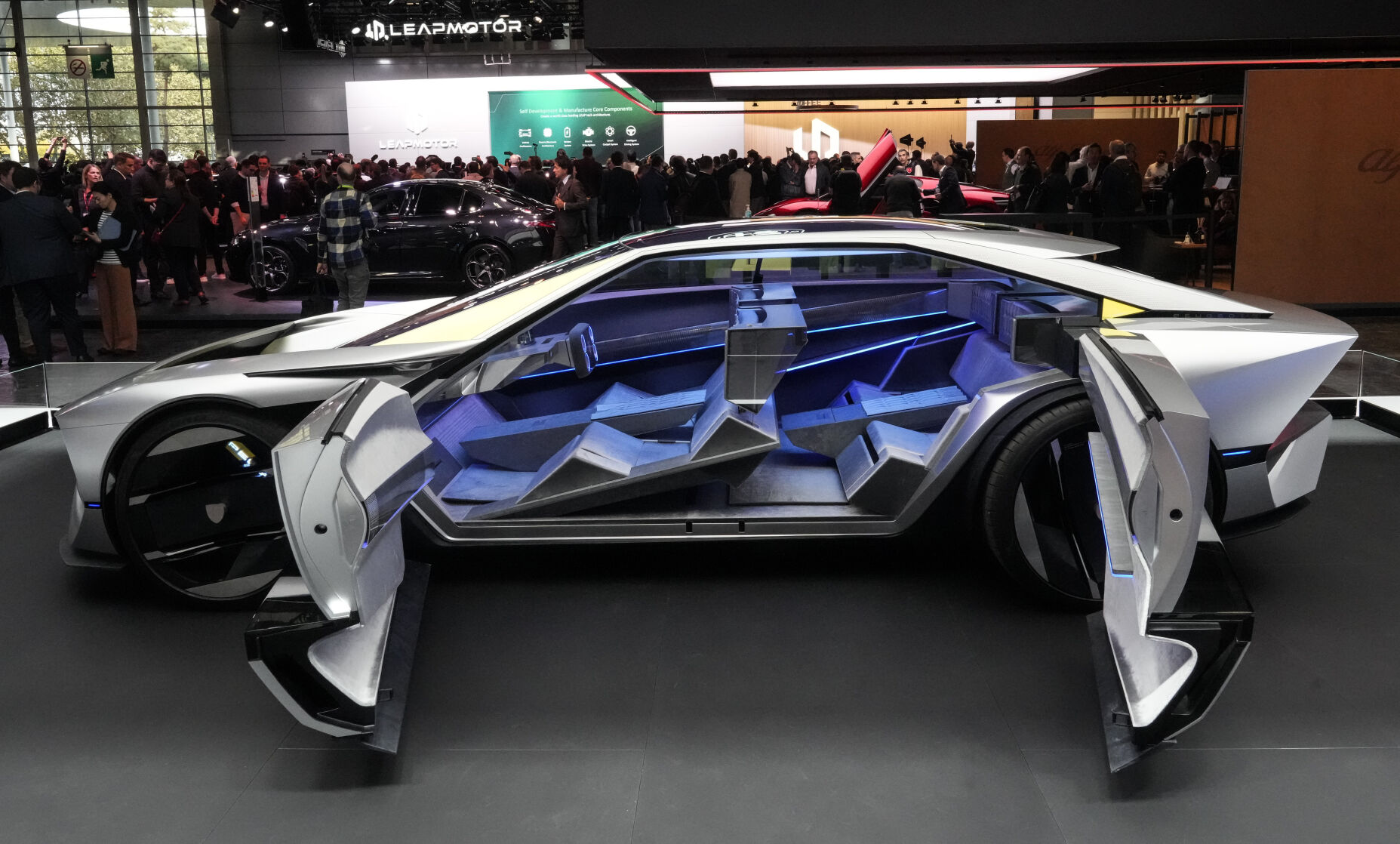

Attending the Paris show for the first time, the decade-old Chinese EV manufacturer XPeng unveiled a sleek sedan, the P7+.

CEO He Xiaopeng said XPeng aims to deliver in Europe from next year. Intended European prices for the P7+ weren’t given, but the CEO said they will start in China at 209,800 yuan, the equivalent of 27,100 euros, or $29,600.

XPeng’s president, Brian Gu, said the EU’s threatened import duties could complicate the company’s expansion plans if Brussels and Beijing don’t find an amicable solution to their trade dispute before an end-of-October deadline.

Brussels says subsidies help Chinese companies to unfairly undercut EU industry prices, with Chinese-built electric cars jumping from 3.9% of the EV market in 2020 to 25% by September 2023.

“The tariff will put a lot of pressure on our business model. It’s a direct hit on our margin, which is already not very high,” Gu said.

VEHICLES FOR YOUNG TEENS

Manufacturers of small electric vehicles that can be driven in Europe without a license are finding a growing market among teens as young as 14 and their parents who, for safety reasons, prefer that they zip around on four wheels than on motorbikes.

Several manufacturers of the two-seaters are showcasing in Paris, including France’s Citroen. The starting price for its Ami, or “Friend,” is just under 8,000 euros ($8,720). Launched in France in 2020, the plastic-shelled vehicle is now also sold in other European markets and in Turkey, Morocco and South America.

“It’s not a car. It’s a mobility object,” said Citroen’s product chief for the Ami, Alain Le Gouguec.

European legislation allows teenagers without a full license to drive the Ami and similar buggies from age 14 after an eight-hour training course. They’re limited to a top speed of 28 mph.

The vehicles are also finding markets among adults who lost their license for driving infractions or who never got a full license, and outside cities in areas with poor transport.

Renault subsidiary Mobilize said that even in winter’s energy-sapping cold its two-seater, no-license, plastic-shelled Duo can go more than 60 miles between charges. A phone app acts as its door and ignition key.

Another French manufacturer, Ligier, sells its no-license two-seaters in both diesel and electric versions.