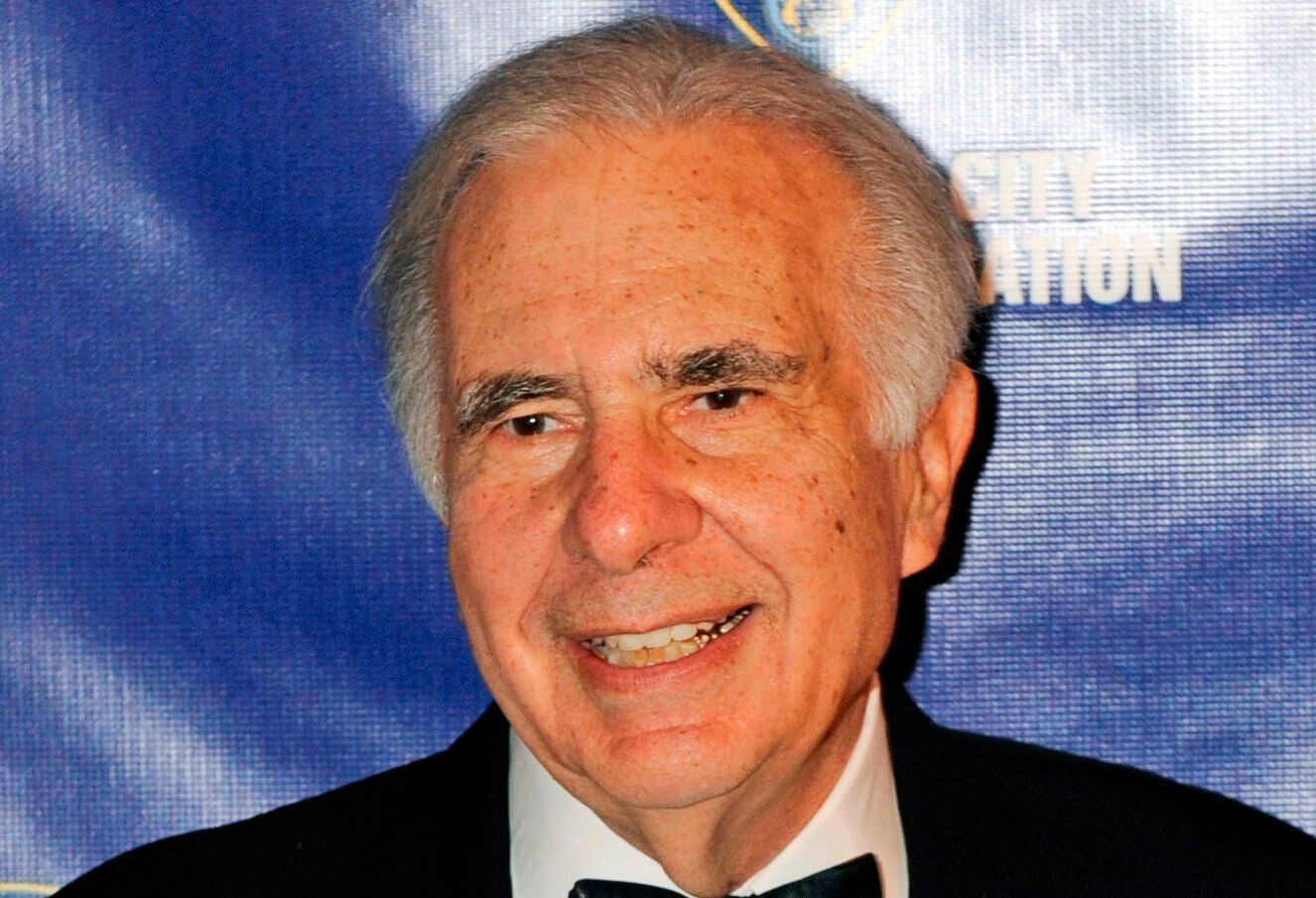

Billionaire Carl Icahn and his company were charged by U.S. regulators with failing to disclose personal loans worth billions of dollars that were secured using securities of Icahn Enterprises as collateral.

Icahn and his company have agreed to pay $1.5 million and $500,000 in civil penalties, respectively, to settle the charges, the Securities and Exchange Commission said today.

The agency said that from at least Dec. 31, 2018 to the present, Icahn pledged approximately 51% to 82% of Icahn Enterprises’ outstanding securities as collateral to secure personal loans with a number of lenders.

The SEC said Icahn Enterprises failed to disclose Icahn’s pledges of the company’s securities as required in its annual report until Feb. 25, 2022. Icahn also failed to file amendments to a required regulatory filing describing his personal loan agreements and amendments, which dated back to at least 2005, and failed to attach required guaranty agreements. Icahn’s failure to file the required amendments to the regulatory filing persisted until at least July 9, 2023, the agency added.

Icahn Enterprises and Icahn, without admitting or denying the findings, have agreed to cease and desist from future violations and to pay the civil penalties.

Icahn did not immediately respond today to a request for comment from The Associated Press.

Shares of Icahn Enterprises were flat at the opening bell.