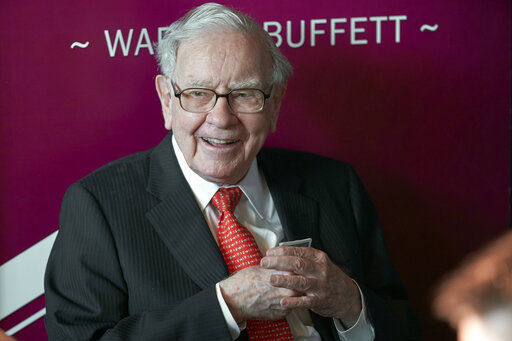

OMAHA, Neb. (AP) — Warren Buffett’s Berkshire Hathaway now owns nearly $11 billion worth of Occidental Petroleum stock after buying another 1.9 million shares in the past week.

The latest purchases of nearly $117 million in stock that Berkshire reported to the Securities and Exchange Commission Monday give the Omaha, Nebraska-based conglomerate control of 19.4% of the oil producer’s stock.

Berkshire is quickly approaching owning more than 20% of Houston-based Occidental’s shares. At that point, Berkshire would be able to start reporting a proportional share of Occidental’s earnings within its own earnings reports, which would give Berkshire a significant boost.

Berkshire has bought more than $1.3 billion worth of Occidental shares this month alone, and now holds nearly 181.7 million shares.

In addition to its current Occidental stake, Berkshire holds warrants to buy another 83.9 million shares for $59.62 apiece that it received in 2019 when it helped finance Occidental’s purchase of Anadarko. Berkshire also holds 100,000 preferred shares in Occidental that pays an 8% dividend

Occidental shares gained more than 1.4% Tuesday to trade at $60.91. Berkshire has been purchasing the stock when it trades below $60. The most recent purchases made last last week were completed at prices between $56.14 and $59.67.

In addition to Berkshire’s investment portfolio, which is dominated by a massive Apple stake, the conglomerate owns more than 90 companies outright, including Geico insurance, BNSF railroad, several major utilities and an eclectic assortment of manufacturing and retail businesses.