Wheat flies on drone attack

Wheat prices finally woke up and reversed mid-week as reports, and then photos, circulated of two drones striking the Kremlin. President Putin immediately blamed the U.S. and Ukraine. Those countries denied responsibility.

While most attention focused on who orchestrated the attack and what Moscow might do in response, farmers and traders were quick to worry about the tenuous wheat exportation agreement for the Black Sea. Russia could again refuse to allow Ukrainian wheat to leave ports as economic retaliation for the alleged strike.

Those fears caused a knee-jerk reaction, with Kansas City winter wheat contracts zipping from two-year lows to up as much as $1 per bushel by Friday afternoon. Dry Southern Great Plains, especially in the western half of Kansas, and wet Northern Plains continue to provide fodder for bulls concerned about supply from North America. The Nebraska crop condition deteriorated to just 14% “good to excellent,” the worst in 10 years.

Crude makes historic swings

The $10 per barrel midweek crash in crude prices was among the fastest and sharpest declines in history, but Friday’s recovery was so dramatic that the net change was tempered. Both the downslide and the recovery were explained, at least partially, by the slowing world economy, rather than the expected energy demand as a result of the solid U.S. jobs report.

New York bans gas stoves

New York has become the first state to ban the sale and installation of gas-fired stoves because they contribute to climate change. While few expect New York’s action to be immediately adopted elsewhere, the decision could foretell a trend in other states.

Interest rates add to commodity costs

As our Federal Reserve raised interest rates to a 16-year high, interest is peaking on the enormous impact of the cost of borrowing on our economy. Just as fertilizers, pesticides, land, labor and fuels add to the cost of production of agricultural and industrial commodities, the cost of interest has become a major consideration for projecting profits and losses for producers and users of all basic commodities.

Even livestock has developed into a corporate endeavor, with tons of cash being moved as animal ownership changes throughout rearing, feeding, processing and transporting operations. Ten year note futures contracts were up a shade this week, showing 10-year rates declined.

Winners and losers

Winners included KC wheat shooting up more than 60 cents per bushel, with cotton gaining about 3 cents per pound.

Losers were hogs down more than 8 cents per pound, crude oil dropped more than $5 per barrel, with gasoline falling more than 16 cents from last Friday’s close.

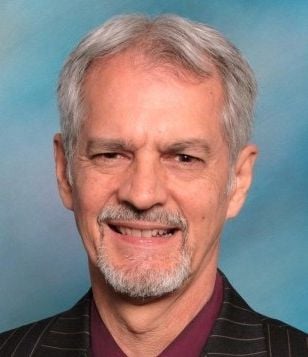

Opinions are solely the writer’s. Walt Breitinger is a commodity futures broker in Valparaiso, Ind. He can be reached at (800) 411-3888 or www.indianafutures.com. This is not a solicitation of any order to buy or sell any market.