Global burning: New normal?

Record high temperatures, floods, forest fires and dire predictions of more to come dominated weather reports all week. Well-respected organizations from across the globe, both private and public, reported a “hottest day” on record or the hottest day for the earth in several hundred years. Most climatologists predict the severe drought will worsen. Scientists continue to warn that a drastic and rapid decline in the release of greenhouse gasses, especially carbon dioxide and methane, is the only hope of stabilizing our climate. Neither of the by far largest emitters — China and the U.S. — seem to be making the progress needed to achieve those crucial reductions.

Crude surges as Saudis cut production

Saudi Arabia’s recent commitment to reduce pumping was one bullish factor this week. The outlook for increased global energy demand provided fuel for optimism as well. China’s commitment to jump-start their economy continues since demand is positive, and declining U.S. stockpiles of crude provide a bullish supply-side element. August crude blasted from a low of $67 per barrel at the end of June to over $73 per barrel on Friday.

Speculation or gambling?

Some investors regard speculation and gambling as synonymous activities, but there are key distinctions that elevate the role of futures contracts. They play a valuable, if not critical, role in our economic system. For example, gambling involves the creation of risk for those who wish to take a risk for entertainment.

Speculation, however, transfers a real and present risk (such as the price of a farmer’s crop) from someone who cannot afford to take that risk (the farmer) to an investor or “speculator” who will accept risk for an opportunity to make a profit. Without futures markets, bankruptcy could befall producers, consumers and processors of our agricultural, mining and energy resources if the price of their commodity swings dramatically.

Winners and losers

This week’s winners include crude oil, which rallied $2.75 per barrel, while lean hogs jumped about 4 cents per pound and oats rose 20 cents per bushel. Losers for the week included stock and bond futures. Corn fell about 30 cents per bushel with wheat dropping 25 cents.

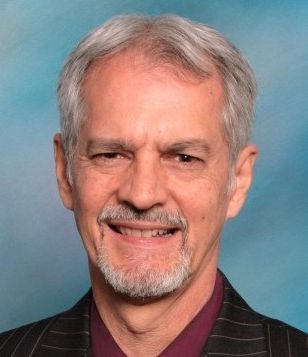

New author of futures file

After 25 years of enjoying and devoting my Fridays to Futures File, your author, Walt Breitinger, will pass the torch to a highly talented and experienced agriculture advisor and risk manager. Mr. Derrick Hermesch of Paragon Investments is in Topeka, Kan., looks forward to carrying the column onward.

We appreciate the many compliments, inquiries and criticisms you have provided during the years, and trust the new author(s) will provide plenty of news, views and education to build your knowledge of the most basic foundation of our civilization and the resources on which it depends.

Opinions are solely the writer’s. Walt Breitinger is a commodity futures broker in Valparaiso, Ind. He can be reached at (800) 411-3888 or www.indianafutures.com. This is not a solicitation of any order to buy or sell any market.