Bonds break

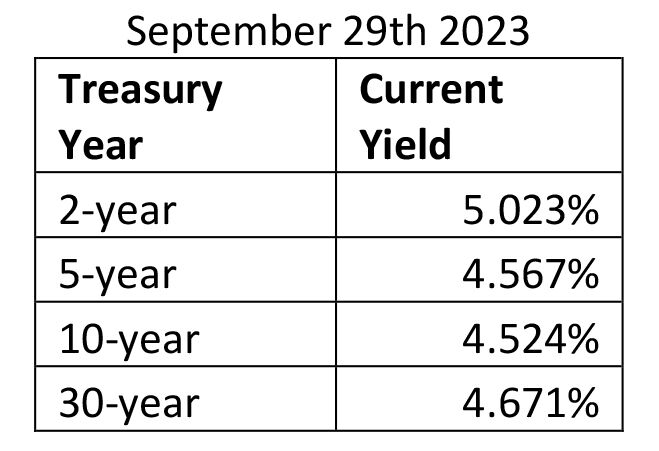

Thirty-year U.S. treasury bonds made a new low this week of 112.31, a low price not seen since November 2007. The 10-year, five-year and two-year treasury notes were also lower on the week, although not as aggressively. The yield curve remains inverted and has been since 2022, but the 30-year yield did some catching up this week.

{{tncms-asset app=”editorial” id=”af7b4b08-5efb-11ee-a22a-8b9763b548c3″}}

Current yields for treasury instruments

An inverted yield curve, when short term yields return higher than long term, has been a prediction in the past of upcoming recessions and recession predictions have been on the radar for the past year. A recession is most commonly identified by a fall in GDP in two successive quarters. And by that metric, we are not in a recession, but there are signs of distress.

Inflation has come down from the peaks of 2022, but it has not been completely tamed. Oil prices have increased 30% since June, which will make it nearly impossible for some of the essentials like food and transportation to be curtailed.

More troubling is that home prices have not retreated significantly even with 30-year mortgage rates nearing 8%. A log jam of current homeowners with rates already locked in at 3.5% or less is keeping the volume of transactions down. But if new developments are to occur in a manner that matches historical averages one would have to imagine that prices will need to come down in order for that to happen. Unless wage growth accelerates, which would lead to more inflation.

Cattle futures cough

Cattle prices for both feeders and fats have been in a bull market since coming off the lows in 2020. In that time, there have been corrective dips but they have not been large or long enough to constitute concern over a market that has continued to face tightening supplies and steady demand.

In the past two weeks nearby feeder cattle contracts have decreased 5% in price. There has not been a fundamental shift in the supply story, but a 5% decrease is enough to raise the question of whether consumer demand is simply clearing its throat or are they catching a cold?

Have a comment or question? Please reach out to derrick.hermesch@pinion.global.com.

Opinions are solely the writer’s. Derrick Hermesch is a commodity futures broker with Pinion. He can be reached at 785-338-9605. This is not a solicitation of any order to buy or sell nor does it provide any recommendations in regard to the market. Information contained herein is believed to be reliable but cannot be guaranteed as to its accuracy or completeness. Past performance is no guarantee of future results or profitability. Futures and options trading involve substantial risk of loss and is not suitable for all investors.