After a year in which sales prices markedly outpaced assessed values for residential properties in Dubuque County, officials from the county and City of Dubuque are set to begin calculating how much property valuations will need to increase.

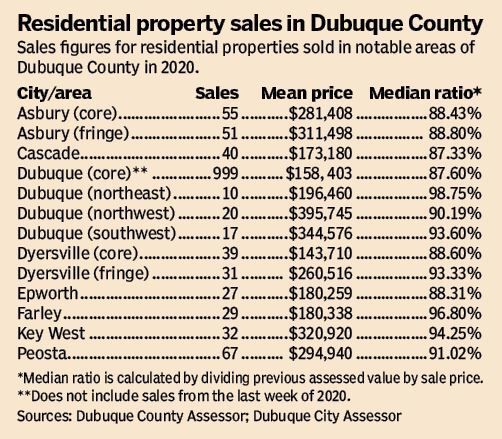

Residential property sales in the city of Dubuque in 2020 had a collective assessed value level of 87.6%. Assessed value levels, or median ratio, are determined by taking a property’s assessed value and dividing it by its sales price. Levels below 100% show that homes sold for more than they were assessed.

In Dubuque County outside of the city of Dubuque in 2020, the assessed value level was 89.7%.

Assessed values are examined in Iowa every odd calendar year. State law mandates that assessed value levels must be between 95% and 105% to keep value assessments equal across the state. Since Dubuque County and Dubuque fall below this range, assessed property values must increase to bump up the level percentage.

County Assessor Dave Kubik said prices generally have increased in recent history, but he was surprised to see that trend hold true given the unique conditions in 2020.

“I was as shocked as anyone else (that sales increased),” he said. “I was sure market values were going to go down for COVID(-19).”

He said the goal for the county is to increase overall assessed values by 8.2% — on properties in Dubuque County outside of the city of Dubuque — to fall within the state’s value range, though that does not mean a uniform, across-the-board increase.

Dubuque City Assessor Troy Patzner said city-specific assessed values must increase anywhere from 7.4% to 12.4% to meet the state threshold. He said city assessed values have typically increased 4% to 5% when they are reexamined.

Both assessors attributed low interest rates to the reason that 2020 saw high residential sales and prices.

Patzner said he still is waiting on sales data from the last week of 2020, but he assumes there will be more than 1,000 residential sales in the city this past year. Elsewhere in the county, there were 497 sales.

While he hasn’t broken down data into individual areas yet, Patzner said the city housing market has remained strong through the COVID-19 pandemic, especially for homes in the $200,000 price range.

“At the initial onset, no, I was anticipating sales were going to be not as strong as they were,” he said. “If there were things like (homeowners) were thinking of moving into something different, they really made those decisions to do that.”

County Recorder John Murphy added that his office had 20,886 real estate documents — files associated with the purchase or sale of a home — come through its doors in 2020. In a typical year since 2014, that total has been between 14,500 and 17,500.

“It’s significantly higher than any other year I’ve been in office, probably due to low interest rates and healthy markets,” Murphy said.

Both Kubik and Patzner look at “map areas” to determine where value levels need to be increased. Kubik’s county map is split into 30 different sections, while Patzner looks at 50 different city neighborhoods.

Kubik said a variety of factors go into calculating the assessed value of a home, including a residence’s condition, age, materials and enhancements. This is known as a “cost approval” appraisal method that allows assessors to keep assessed values as close to the market value of a property as possible.

“It’s kind of an after-the-fact type of approach,” he said. “We don’t really just add 6% to Epworth and 8% to Asbury. This appraisal method tries to mirror values of what properties have sold for.”

Kubik added that a recent survey conducted statewide shows Dubuque County is not unique in having to increase assessed values this year.

“Of the 61 jurisdictions that have responded, only four are not changing values,” Kubik said. “No one is decreasing values. The information shows a lot of people in the low 90s.”

Owners will be notified of their new assessed values in March after assessors’ offices complete their calculations. But until then, both Kubik and Patzner said it was too soon to tell how property taxes will be affected by increasing assessed values.

“At this point, we don’t know what taxes are going to do,” Patzner said.